DRB Capital is a market leader in structured settlement receivables – delivering disciplined asset origination, portfolio sourcing, and servicing solutions for institutional partners.

Since 2013, DRB Capital has been a trusted partner in the structured settlement secondary market. We specialize in sourcing, acquiring, and servicing structured settlement receivables and annuities, with a proven track record built on transparency, compliance, and results.

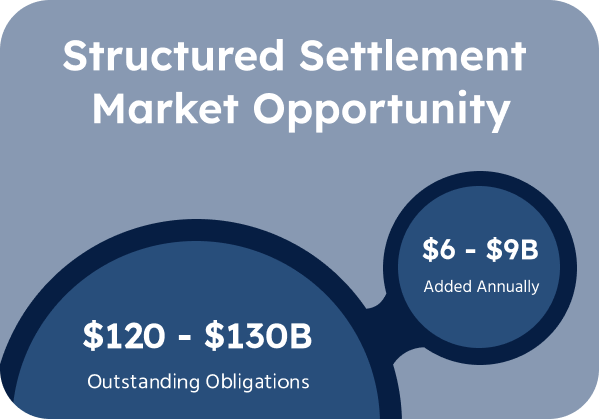

Structured settlements represent court-ordered payment obligations funded by highly rated insurance companies. These cash flows are uncorrelated with traditional markets and are backed by contractual payment obligations. With $120-$130 billion of outstanding obligations and $6-$9 billion added annually, this market provides an attractive opportunity for institutional investors seeking reliable, long-duration cash flows.

DRB Capital provides institutional investors with direct access to structured settlement receivables through three core capabilities: Asset Origination, Portfolio Sourcing, and Cash Flow Servicing. Our disciplined approach and nationwide platform allow us to source high-quality assets, execute efficiently, and manage portfolios with industry-leading compliance and transparency.

Proprietary retail and wholesale channels that generate a consistent pipeline of structured settlement receivables.

Expertise in portfolio acquisitions, leveraging scale to capitalize on market opportunities.

Comprehensive servicing capabilities designed to manage and optimize structured settlement portfolios.

DRB Capital is guided by an experienced executive team with deep expertise across finance, capital markets, and specialty servicing.

From our formation in 2013 to leading structured settlement servicing in 2025, DRB Capital continues to expand its expertise and market presence.

Interested in learning more about DRB Capital’s structured settlement capabilities? Connect with our team.